In the complex structure of international trade, delivery methods are very important to clarify responsibilities between the buyer and seller. One of these delivery methods, CIP delivery, or Carriage and Insurance Paid To, is among the most preferred methods. So, what is CIP delivery, how does it work, and who is it suitable for? We examine the full details of the CIP term, its operation, and advantages.

What Does CIP Mean?

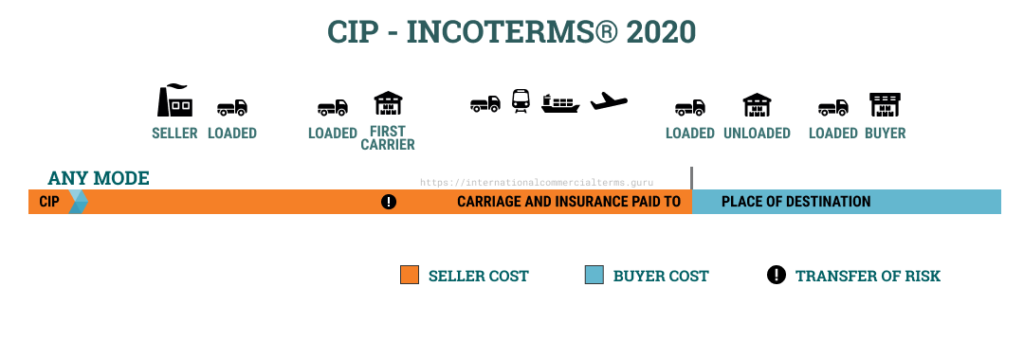

CIP is an important delivery method in international trade. This delivery method means that the seller sends the goods by paying transportation costs and transportation insurance up to the designated destination. The seller bears all necessary expenses to ensure the safe arrival of the goods to the buyer. CIP Incoterms defined by the ICC (International Chamber of Commerce) is a delivery method valid for all modes of transportation. This includes sea, air, and land transportation. The advantage of this delivery method is that it provides the buyer with more security within the scope of the seller's obligations. CIP clearly defines the responsibilities between parties in international trade, facilitating commercial relations.

CIP Expansion

CIP means "Carriage and Insurance Paid To" in English. Its Turkish equivalent is "delivered with carriage and insurance paid." It is one of the Incoterms rules used in international trade, meaning that the seller covers transportation and insurance costs until the specified destination. The buyer receives the goods at the destination point and assumes the risks from that point onward.

How Does the CIP Delivery Method Work?

The CIP delivery method is a system where the seller arranges with a transportation company and, on the condition of also arranging transportation insurance, sends the goods to the designated point. The answer to the question "What is CIP Incoterms?" is important to understand how this delivery method functions in international trade. The seller pays the freight and insurance costs, assuming all risks until the delivery point. Sea freight and container transportation ensure the safe transportation of loads. During the transportation process, loading and unloading stages are carried out between ports. After the buyer receives the goods at the delivery point, they assume the risks of loss or damage. Therefore, transportation insurance is an important protection mechanism for both the seller and the buyer. Thanks to the cost advantages offered by international sea transportation, trade is facilitated. Careful logistics management at every stage guarantees that loads arrive on time and safely.

The CIP delivery method is a system where the seller arranges with a transportation company and, on the condition of also arranging transportation insurance, sends the goods to the designated point. The answer to the question "What is CIP Incoterms?" is important to understand how this delivery method functions in international trade. The seller pays the freight and insurance costs, assuming all risks until the delivery point. Sea freight and container transportation ensure the safe transportation of loads. During the transportation process, loading and unloading stages are carried out between ports. After the buyer receives the goods at the delivery point, they assume the risks of loss or damage. Therefore, transportation insurance is an important protection mechanism for both the seller and the buyer. Thanks to the cost advantages offered by international sea transportation, trade is facilitated. Careful logistics management at every stage guarantees that loads arrive on time and safely.

Seller's Responsibilities in CIP Delivery

Under the CIP (Carriage and Insurance Paid to) delivery terms, the seller has a series of responsibilities. First, the seller completes export customs procedures and, during this process, arranges all necessary documents to ensure the goods exit the country. At this stage, freight and insurance costs are paid by the seller, so no additional financial burden is placed on the buyer. The seller securely packages and labels the goods and delivers them to the transportation vehicle. This process is extremely important to prevent damage during transit. Additionally, the seller arranges transportation insurance to protect the buyer; thus, taking precautions against possible damages or losses. The seller organizes transportation to deliver the goods to the location specified by the buyer. The purpose of these responsibilities is to guarantee that the goods reach the designated point without damage and in full. Fulfilling these responsibilities contributes to maintaining healthy commercial relations with the buyer.

Buyer's Responsibilities in CIP Delivery

The CIP (Carriage and Insurance Paid to) delivery method indicates that the buyer has certain responsibilities in international trade. First, the buyer obtains the necessary permits and documents for import. Preparing these documents completely is critical for a smooth process. Additionally, when the product arrives at the destination, the buyer must carry out customs procedures at the destination and be attentive during this stage. During customs procedures, the buyer is responsible for paying all customs duties, taxes, and additional expenses related to the product. Failure to pay these costs on time can delay or prevent the release of the product from customs. The buyer should plan a budget considering all these financial obligations. After receiving the products, the buyer assumes the risk of potential damage. Therefore, careful inspection during delivery and noting any damages is important. Especially companies receiving products via CIP delivery should manage these processes meticulously. Otherwise, the risk of encountering adverse situations increases.

Details of Transportation Insurance in CIP Delivery

Transportation insurance is an indispensable part of CIP delivery. This type of insurance provides protection against risks that may occur during transportation and requires the seller to take necessary precautions to ensure the safety of the goods. The seller is obliged to obtain insurance that covers risks during transportation. Usually, the insurance has "minimum coverage," but parties can agree on a more comprehensive policy if they wish. This is especially important when transporting valuable goods. Obtaining broader transportation insurance for valuable items is a critical step to minimize potential damages. Detailing the terms of transportation insurance ensures a secure transaction for both the seller and the buyer. It is important for parties to analyze the policy coverage carefully and make a plan suitable for their needs.

Uses of CIP Delivery Method

- The CIP delivery method is widely preferred in various sectors:

- Electronics and technology products

- Textile and ready-to-wear industry

- Chemical substances and pharmaceutical trade

- Automotive spare parts shipments

- Agricultural products and foodstuffs

Important Considerations in CIP Delivery Contracts

CIP transportation contracts ensure the safe conduct of trade. However, some points need attention. First, the destination must be clearly specified. Ambiguities can lead to misunderstandings between parties and negatively affect trade relations. The insurance coverage details should be written explicitly. Insurance is critical for the safe transportation of the load. Loading and unloading costs should be clearly assigned to one side. This prevents potential financial disputes between parties and helps both sides understand their obligations. When details are not specified in writing, disputes may arise between parties. Therefore, it is advisable to seek professional support when preparing CIP contracts. Experts can help ensure the contract is arranged to meet the needs of both parties, ensuring the smooth progress of the trade process.