A proforma invoice is an important document frequently encountered in the trade and finance sectors. By answering the question “What is a proforma invoice?”, we aim to compile information that can benefit your business. Let’s start with a brief definition:

What Is a Proforma Invoice?

A proforma invoice is mostly considered a quotation document and is prepared to inform the buyer in advance about the cost of a specific product or service. It does not create any financial obligation and is not regarded as an official invoice. From a trade and tax law perspective, a proforma invoice is not mandated by any regulation. Companies can customize the proforma invoice according to their needs. While providing details of the offers made to potential customers, it also helps facilitate an agreement between the parties.

What Are the Conditions That Must Be Included in a Proforma Invoice?

- Freight and insurance costs.

- Method of shipment.

- Date of the invoice.

- Name/trade name and address details of the seller and buyer.

- Payment method.

- Origin of the goods.

- Method of delivery.

- Unit cost/quantity/total of the goods or services.

- Detailed descriptions such as packaging features, serial numbers of the goods, etc.

What Are the Differences Between a Proforma Invoice and a Normal Invoice?

A proforma invoice is a document that provides information about the product or service before it is presented to the buyer. It serves as a commitment towards the buyer and is generally used at the beginning of the sales process. On the other hand, a normal invoice is issued after the delivery of the goods or services and specifies the amount the buyer needs to pay. Both types of invoices are important documents in commercial transactions, but they differ in their functions and legal requirements.

A proforma invoice does not need to be recorded in the income-expense ledger; it is a preliminary stage before a formal transaction between the buyer and seller. However, once the invoice is issued, both parties are required to record it in their books. The proforma invoice provides information related to the product or service to be delivered and acts as a commitment. The normal invoice, however, contains the amount the buyer must pay, prepared by the seller.

What Are the Features of a Proforma Invoice?

In addition to providing high-standard service to customers, different documents can be prepared to facilitate agreements in understandable terms and conditions. These include invoices, offers, contracts, and invoice-like documents. In the market, it is common to prepare and provide documents similar to invoices. One of these is the proforma invoice.

We can consider the proforma invoice as a pre-contract document. Besides being a commercial document, it generally serves as an offer containing the terms and prices related to the sale of goods or services. It clarifies the details of the agreement between the buyer and seller and defines their mutual obligations.

One of the most notable features of a proforma invoice is that it is generally not regarded as an official invoice; therefore, it is not included in accounting records. Due to this, proforma invoices are typically used as temporary documents prepared before a sale, containing price quotes and payment terms. After reviewing and accepting the proforma invoice, the buyer can return to the seller to complete the agreement.

Where Is the Proforma Invoice Used?

The proforma invoice plays an important role in import and export transactions. It is especially used when it needs to be prepared before shipment based on the exporter’s offer to the importer or based on an agreement between the parties for opening a letter of credit.

When the importer accepts the offer presented by the exporter and wishes to place an order based on this approval, they should indicate their acceptance of the terms of the invoice type. The proforma invoice contributes to establishing effective communication between the two parties at the beginning of the buying-selling process.

The proforma invoice acts as a kind of preliminary agreement in commercial transactions, allowing the parties to clarify their responsibilities and expectations. This reduces potential problems as the process progresses.

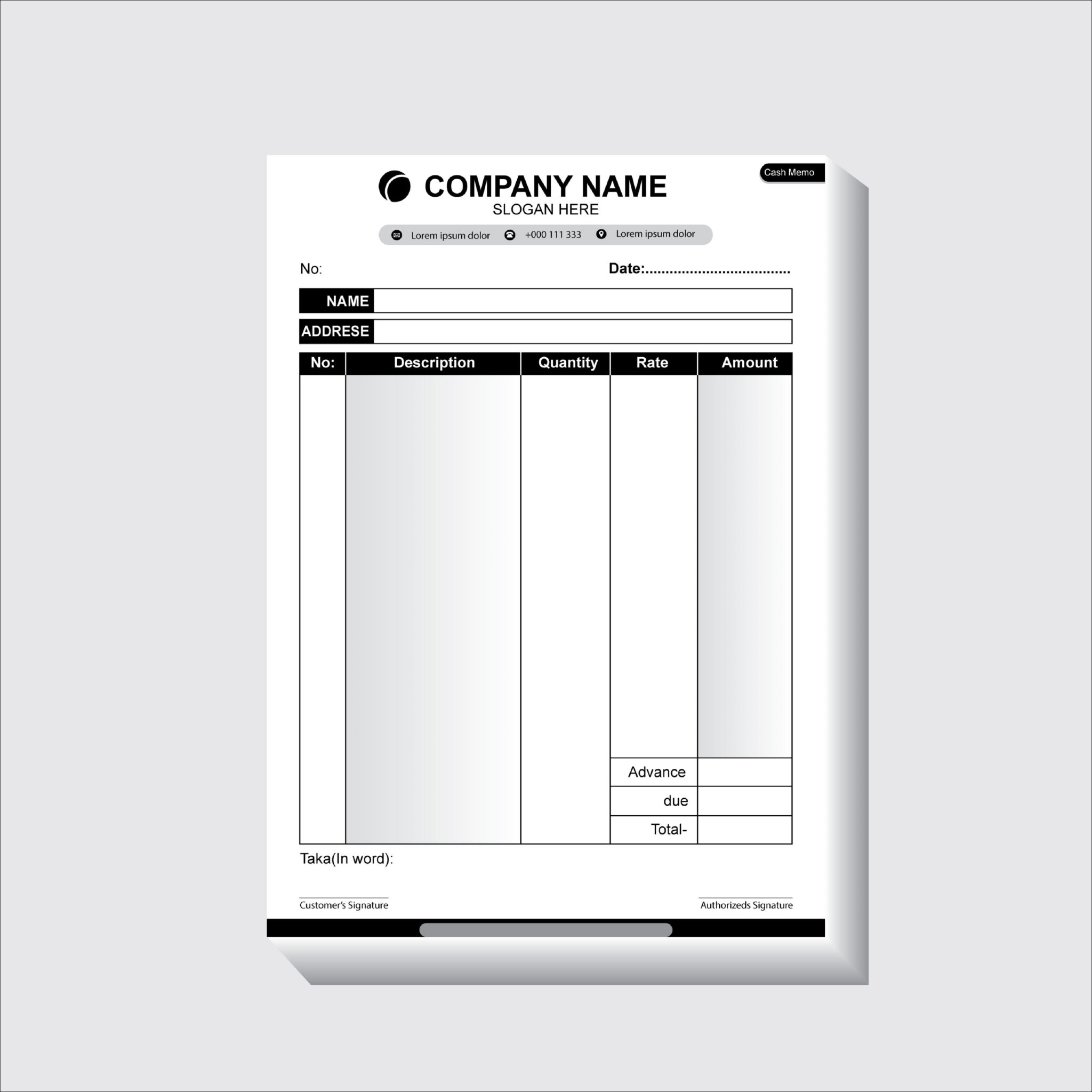

Proforma Invoice Example

Proforma Invoice

Seller Information

Company Name: Import and Export Ltd. Şti.

Address: Example Mah. 123. Sok. No:45 Istanbul

Phone: +90 212 1223 45 67

Email: info@abcihracat.com

Buyer Information

Company Name: Trade A.Ş.

Address: Trade Cad. No:25 Ankara

Phone: +90 312 987 65 43

Email: satınalma@xyzticaret.com

Invoice Details

Invoice Date: January 28, 2026

Invoice Number: PF-20260128-001

Payment Method: Bank transfer / EFT

Delivery Method: FOB – Istanbul

Product List

| Product Name | Quantity | Unit Price | Total Amount |

|---|---|---|---|

| Sample Product 1 | 100 units | 50 USD | 5,000 USD |

| Sample Product 2 | 200 units | 30 USD | 6,000 USD |

| Sample Product 3 | 150 units | 40 USD | 6,000 USD |

| Total | 17,000 USD |

Notes

- This document is prepared for informational purposes only and does not replace an official invoice.

- The delivery time is estimated to be 10 business days.

Authorized Signature