Nowadays, the waybill is an important document for businesses in commercial activities. So, what is a waybill and in which situations is it used?

Definition of the Waybill

The waybill is an official document issued during the transportation of goods from one place to another. This document serves as a legal record for both the sender and the carrier. The waybill officially documents the shipment and delivery process of the goods. Especially in commercial transactions and VAT applications, the use of the waybill is mandatory. Commercial enterprises prepare this document while transporting their goods to fulfill their legal obligations and prevent potential issues. Thanks to this document, it is possible to record information such as where the goods are going, when they are transported, and who received them.

Who Prepares the Waybill?

Seller companies prepare a waybill when sending products to customers. This document creates an important record for both the seller and the buyer during the transportation process. The waybill indicates under what conditions, when, and from where the products are sent. Transportation companies request the waybill before carrying out the shipment. Because it contains information about the goods to be transported and their quantities, it ensures that the transportation process proceeds smoothly. Transportation companies use this document to verify whether the cargo has been delivered securely. Today, with the electronic waybill application, this process can also be carried out digitally. Electronic waybills facilitate fast and effective communication and allow all parties easy access.

Electronic Waybill and E-Waybill

In recent years, with digitalization, the e-waybill system has been introduced. By transferring traditional waybill practices to a digital platform, it makes business processes more efficient. Now, the waybill can be created digitally, reducing paper waste and speeding up the process. The e-waybill simplifies the tracking of documents between the sender, carrier, and receiver. Thanks to this system, all parties can view and track the documents in real-time. Since the e-waybill is created on an official and secure electronic platform, it has legal validity. The e-waybill application is a significant innovation in the logistics sector and makes the operations of companies easier. With digitalization, the difficulties encountered in transportation processes are minimized, and efficiency is increased.

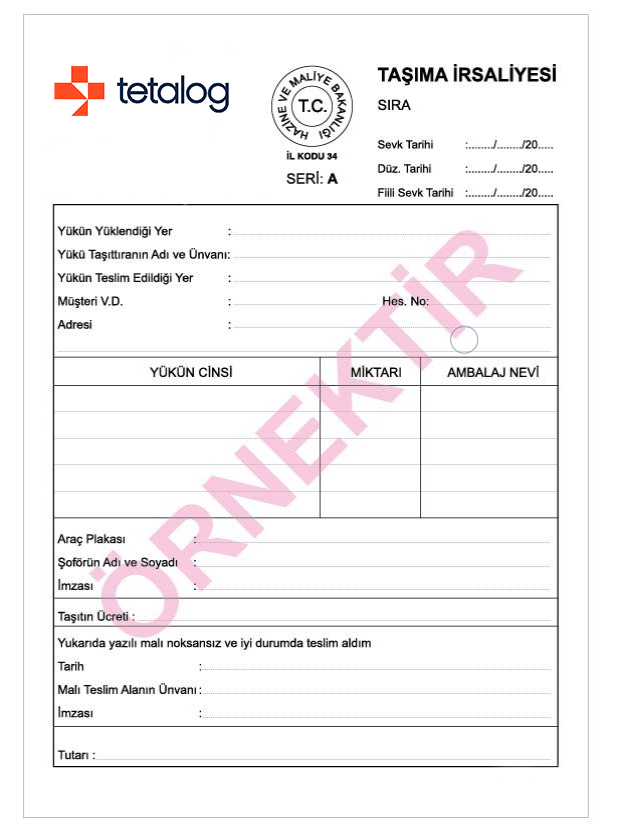

Required Information in the Waybill

When the e-waybill is prepared, all this information is recorded electronically and can be tracked in the system.

- Name, address, and tax number of the sender and receiver

- Type of goods, quantity, and unit price

- Shipment date

- Carrier company information and vehicle license plate

- Waybill number and date of issuance

Why is the Waybill Important?

The waybill is a critical document for the proper conduct of commercial transactions. Firstly, it provides a legal proof for tax inspections; thus, businesses can present their documents to tax authorities and prove that they have fulfilled their obligations. It also documents that the goods have been received, ensuring that the delivery between the buyer and seller has been correctly executed. The waybill prevents potential disputes during transportation. Clearly indicating details such as the conditions of delivery, timing, and who received the goods makes it easier to resolve possible issues between parties. It is necessary for VAT refunds and accounting records; businesses can use this document to complete the necessary paperwork for VAT refunds and carry out their accounting processes properly.

Visit our page for information about our Dubai cargo transportation service!

The Relationship Between the Waybill and VAT

The waybill is an important document that certifies the physical transportation of goods from one place to another in commercial transactions. The waybill is used as proof of goods shipment in VAT declarations. It is necessary to confirm that the goods have been delivered to the buyer and to ensure the correct calculation of VAT during this process. Especially, businesses may make mistakes in VAT applications without understanding what is a waybill. Incorrect or incomplete information filled in these documents can lead to errors in VAT declarations. This may cause problems during tax audits. Businesses need to prepare the waybill correctly and carefully check its content. One of the most important aspects to pay attention to in VAT calculations is the proper documentation of the goods shipment.

Precautions When Preparing a Waybill

The most important point when preparing a waybill is to ensure that the document is complete and contains accurate information. Entering the date and waybill number without errors is also mandatory for the validity of the document. Mistakes in date and number entries should be avoided to prevent potential legal issues in the future. With technological advancements, the use of E-Waybills and digital record keeping is becoming widespread. E-waysbills allow digital storage of documents and quick access when needed.

Is a Waybill Mandatory?

Yes, the waybill is legally mandatory for commercial goods transportation. It documents the origin of the goods and the transportation conditions, preventing possible disputes.

How to Obtain an E-Waybill?

The E-Waybill can be generated through the online portal of the Revenue Administration. By filling in the required information on this portal, it is possible to create a waybill quickly and easily. Users can follow the steps provided by the system to complete their documents accurately.

Is a Waybill the Same as an Invoice?

No, while a waybill documents that the goods have been transported, an invoice shows sales and payment details. The waybill plays an important role in the delivery of goods and records the transportation process. The invoice, on the other hand, confirms that the commercial transaction has been completed and payment is due.

What to Do If the Waybill Is Lost?

If the waybill is lost, a new one should be prepared first, and the records should be updated with the missing document. The loss should be reported to the relevant units.

Advantages of E-Waybill

The E-Waybill offers quick processing in digital environment, saving time. With secure record keeping, the risk of losing documents is minimized. Easy tracking helps make processes more transparent and manageable.

You may be interested in: What is the CMR Document?